10. How to choose your Investment?

There are over dozens of factors that you should consider when picking any Security:

- Volume

- Liquidity

- Dividend

- Historical performance

- Tax efficiency

- Underlying index and how the stocks are weighed (Funds only)

- Management fees (Funds only)

- ...

It's a lot of work analysing a Security, and a bad idea buying blindly something someone else suggested. This can become some overly complex territory when weighing all those considerations.

Diversification

It's crucial to avoid putting all your money into just a few Stocks. Let's say you did your thorough research and picked Mærsk and DSV, two Danish shipping companies, and invest all your money in their stocks. An event like a geopolitical crisis in the Suez Canal—similar to the Evergreen blockage in 2021 or the Red Sea Attacks in 2024—could significantly devalue these Stocks, or your whole investment!

It's important to spread your investment across several sectors such as healthcare, IT, and energy. This way, you wouldn’t be as affected by sector-specific issues. This strategy, known as Diversification, is a fundamental principle in investing.

ETFs and Danish Investment Funds

Achieving Diversification on your own with Stocks can be overwhelming and expensive, as you have to buy the Stocks at full price, where each single Stock could cost 5000 DKK. Therefore, we will focus on ETFs and Danish Investment Funds for long-term investments. These provide a highly diversified investment product at a fraction of the cost of each underlying Security.

However, even ETFs and Danish Investment Funds can be risky depending on their diversity. For instance, some may only follow the top ten IT companies in the US, while others track indexes that follow the entire world market. Therefore, we should focus on ETFs or Danish Investment Funds that follow low-risk indexes. Additionally, we will introduce you to some general investing terminologies and considerations to help you identify the best ETFs and Danish Investment Funds that track these low-risk indexes.

Low-risk Indexes

Below is a list of popular low-risk indexes:

| Index | Description |

|---|---|

| S&P 500 | Tracks the top 500 large cap companies in the United States. |

| MSCI World Index | Tracks 23 developed countries (e.g. USA and Europe) of around 1.500 companies. |

| MSCI Emerging Markets | Tracks 24 Emerging Market countries (e.g. Indonesia and China) in five different regions and more than 1.400 companies. |

| MSCI All Country World Index (ACWI) | ACWI is a combination of the World Index and Emerging Markets. |

| MSCI Europe | Follows the largest stocks from 15 European Countries |

ETFs or Danish Investment Funds that follow any of those indexes should be our focus.

General investing terminologies and considerations

The following terminologies and considerations are not only limited to ETFs or Danish Investment Funds.

Identifier: ISIN & Ticker Symbols

The ISIN code is the individual Security's name or address. It is short for International Securities Identification Number and consists of a 12-digit code. You can use the ISIN code to look up a security. If you only have the name of the Security, you may be left with many different ETFs to choose from. Many ETFs trade under similar names. They can be for example accumulating or dividend-paying. They could also be traded in different currencies. By using an ISIN code, you are sure that you will find the right Security. You can compare it with a security's CPR number or number plate.

A ticker (symbol) is a shorter and more precise abbreviation, since it identifies the Security at a Stock Exchange level (e.g. SXR8 or CSPX).

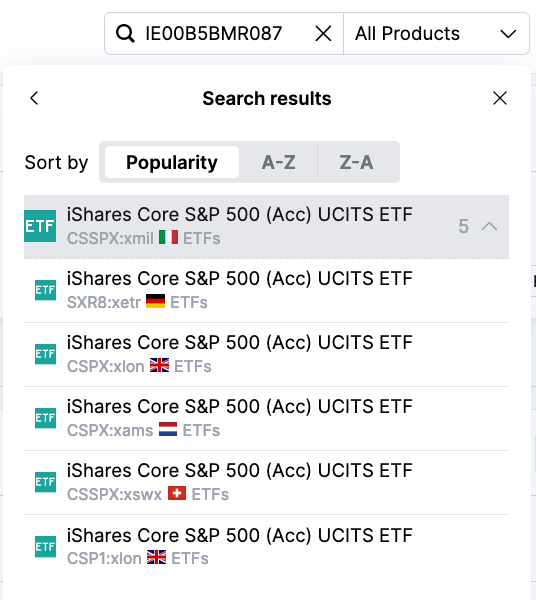

For example, the "iShares Core S&P 500 UCITS" ETF with ISIN "IE00B5BMR087" is traded on six stock exchanges.

It has a different ticker symbol depending on where it is traded. In above's picture, "CSPX" exists twice, but these are then even further separated by the colon (:) separator followed by the Stock Exchange's code "xlon" (London Stock Exchange) and "xams" (Euronext Amsterdam). You should always have an interest to trade on the Stock Exchange in your country or with the highest liquidity.

UCITS

UCITS stands for Undertakings for Collective Investment in Transferable Securities. It's a set of rules in the EU governing investment Funds. These rules ensure Funds diversify their investments, manage risks well, and limit exposures. They also regulate how UCITS can be marketed and sold to investors. The main aim is to increase protection for investors. This also means that the underlying assets are generally simple and therefore also easy to understand. Many European ETFs, and all Danish Investment Funds are created under the UCITS directive (Sources: 1, 2).

"D", "C", "Dis", "Acc",... in the ETF or Danish Investment Fund names?

When you see words like "D", "C", "Dis",... or "Acc" in the names of ETFs or Danish Investment Funds, they indicate whether the the Fund is accumulating or dividend-paying.

"C", "Acc", "Akk": Typically refer to accumulating funds. "D", "Dis", "Dist": Generally denote dividend-paying funds.

However, this is not a requirement and those words can have entirely different meaning. Always check up the Fund's profile before investing!

Picking between similar looking Securities

When looking for instance for an ETF that tracks the S&P 500 index, you may find yourself overwhelmed by dozen or hundreds of choices:

- iShares Core S&P 500 ETF (IVV)

- iShares Core S&P 500 UCITS ETF USD (IUSA)

- Vanguard S&P 500 ETF (VOO)

- iShares Core S&P 500 (Acc) UCITS ETF (SXR8)

- SPDR S&P 500 ETF (SPY) ... to name a few. This is quite common for Funds since there is not one Fund that could track e.g. the S&P 500.

However, why are there so many if all they do is track the same index?

Well, each one has different features — some might be cheaper, some might be easier to buy depending on where you live, and some might come with extra benefits like tax efficiency. Here are some key factors to consider when comparing funds, using "S&P 500 ETFs" as examples:

- Costs: Some have higher management fees than others. For example, SPDR S&P 500 ETF (SPY) is at 0.0945%, which is more than triple of Vanguard S&P 500 ETF (VOO) or iShares Core S&P 500 ETF (IVV) rate of 0.03%.

- Accessibility: Some are designed for investors from certain countries or those who use specific currencies. For example, iShares Core S&P 500 ETF (IVV) is traded in the US or Australia in their local currencies (USD and AUD), whereas iShares Core S&P 500 UCITS ETF USD (IUSA) is traded in Europe on German, British, Swiss and other countries in their local currencies (GBP, EUR, CHF).

- Tax considerations: Depending on where you live, where the ETF is registered, and your countries tax policies you might pay different amounts of tax depending on your choice. For example, since iShares Core S&P 500 UCITS ETF USD (IUSA) ETF is on "SKATs positivliste", you pay a minimum of 27% (or 17% with an Aktiesparekonto), instead of 37%. Furthermore, the ETF pays dividends, and [[6. Taxes#Double taxation on dividends on foreign Stocks & Funds|since it's registered in Ireland you only pay dividend taxes in Denmark]].

- Liquidity: How easy it is to buy or sell the ETF. Two primary indicators of liquidity are the ETFs trading volume and the spread ratio. For example, iShares Core S&P 500 ETF (IVV) has a daily average volume trade volume of 5.5 Million with a spread rate of 0.01%., meaning it's easy to buy and sell.

- Accumulating or Dividend-paying: Some ETFs like iShares Core S&P 500 (Acc) UCITS ETF (SXR8) are accumulating, others are returning the dividends to the investors like the iShares Core S&P 500 UCITS ETF USD (IUSA).

From a Denmark viewpoint, the iShares Core S&P 500 (Acc) UCITS ETF (SXR8) is a great option between all other S&P 500 ETFs since it has:

- low cost of 0.07%

- on "SKATs positivliste", meaning you pay a minimum of 27% (or 17% with an Aktiesparekonto), instead of 37%.

- is highly liquid

- accumulating, meaning gains are reinvested into the ETFs yielding probable greater returns in the future but is inventory taxed (Dk: Lagerprincippet)

Choosing a Security that is traded on several Stock Exchange

How to decide when a Security like a Stock or ETF is traded on multiple exchanges? As we've seen with our iShares Core S&P 500 (Acc) UCITS ETF (SXR8) with ISIN "IE00B5BMR087", the ETF is traded on more than 6 stock exchanges.

You should choose the stock exchange with the highest liquidity and if the Security pays dividends, then you should choose the country with the best tax conditions.

If you're buying the security with a different currency from your investment account (aka, anything that is not traded in DKK), the currency part doesn't really matter much. The conversion rate remains consistent with SAXO and Nordnet. Securities like ETFs and Stocks have a base currency, but they can be traded in various currencies without affecting their underlying value. For example, take the iShares Core S&P 500 (Acc) UCITS ETF (SXR8) ETF, which base currency is USD. If you buy it on the German stock exchange using Euros, its value will still mirror the movements of the US dollar, just as if you bought it directly on the Swiss Exchange, where it's listed in USD.

Fun Fact:

- Danish National bank keeps the DKK exchange rate fixed against the Euro at 1 EUR = 7,46 DKK

- Currencies are not bound to a stock exchange's location. For example, the "iShares Core S&P 500 (Acc) UCITS ETF (CSSP:xswx)", traded on the Swiss Exchange is traded in USD, instead of the country's Swiss Frank (CHF) currency.